Financial Planning in Florida

Why Planning Matters Now

Many Floridians feel behind on retirement. Our approach to retirement planning in Florida turns worry into a simple plan—aligning income timing, healthcare costs, and day-to-day decisions. From

Fort Lauderdale to

Davie and

Sunrise, we help you see what you have, what you’ll need, and the steps to get there.

Your Florida Retirement Roadmap

A practical roadmap you can follow.

- Take stock: accounts, savings, pensions, and insurance—one organized view.

- Map income sources and timing (including Social Security filing at 62, FRA, or 70).

- Estimate healthcare: Medicare premiums, drug costs, and potential long-term care needs.

- Build a simple action list with dates, documents, and next steps.

Tools We Use

Conversations about risk comfort, expense mapping, and coverage reviews—kept plain-English and Florida-focused—so decisions match your lifestyle and budget.

Your Sweet Retirement

Securing a stable retirement takes foresight. By preparing for the unexpected and building a clear strategy, you can move toward Your Sweet Retirement with confidence. Together we’ll set a foundation that supports the life you’ve worked hard for—now and later.

Financial Planning

We begin with the bedrock—a solid plan. We review your entire financial picture to confirm direction, highlight gaps, and prioritize actions. The goal is clarity: what to do first, what can wait, and how each decision affects cash flow in Florida.

Financial Overview

Your Financial Overview is a snapshot that summarizes assets, income sources, fixed expenses, and insurance coverage. It helps you see how close you are to your goals and which adjustments can make the biggest difference.

Action Plan

Your Action Plan aligns how you invest and protect with what you’re comfortable risking—reducing stress by matching choices to your timeline. Clear steps, plain language, and realistic dates keep momentum.

Retirement Compass

Your personalized Retirement Compass report outlines projected income, spending, and key decisions over time. We review tradeoffs, update assumptions, and keep the plan moving in the right direction.

Lifetime Income Plan

The Lifetime Income Plan shows sustainable withdrawal ranges and how to align paychecks from savings with Social Security timing and Medicare costs—so your plan supports everyday life across Broward County.

Women's Investing

We support women who want a clear voice in their financial future. Conversations include Social Security timing, Medicare guidance, budgeting for care, and steps to maintain independence through life transitions across the region.

Coordinating Medicare & Care Costs

Health coverage affects cash flow. We compare

Medicare Advantage, Medigap, and Part D

options and discuss how

long-term care insurance in Florida could fit your plan—before decisions impact your budget.

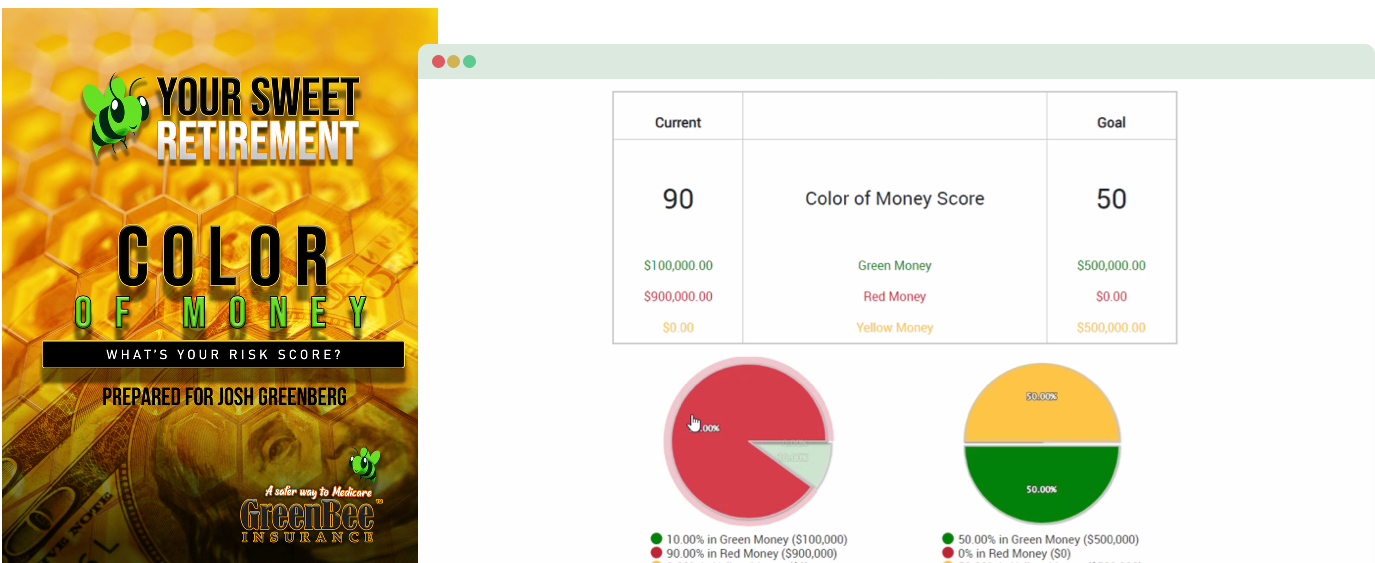

WHAT'S YOUR RISK SCORE?

The Color of Money

Answer 11 straightforward questions to gauge a risk level that matches your peace of mind. You’ll receive a simple report to use during your planning session.

Download a sample report here.

Florida Retirement FAQ: What You Need to Know

Clear answers to common planning questions in Florida.

Do you help coordinate Medicare with my retirement income plan?

Yes. We review Medicare Advantage, Medigap, and Part D choices alongside your monthly cash flow so premiums and prescriptions are planned for.

Can you review Social Security timing as part of the plan?

We’ll outline how filing at 62, full retirement age, or 70 changes monthly income and how that interacts with your budget in Florida.

How often do we update the plan?

We recommend a yearly review—often ahead of Medicare Open Enrollment—to reflect life changes and plan updates.

Do you create a written action list?

Yes. You’ll leave with clear next steps: coverage options to compare, documents to gather, and timelines to track.

Can we meet virtually if I’m in Davie or Sunrise?

Absolutely. Phone and video appointments are available statewide.